japan corporate tax rate 2020

Tax rates for corporate income tax including historic rates and domestic withholding tax for more than 170 countries worldwide. This page provides - Japan Corporate Tax Rate - actual values historical data forecast chart statistics.

Corporate Tax Reform In The Wake Of The Pandemic Itep

The rate is increased to 10 to 15 once the tax audit notice is received.

. An under-payment penalty is imposed at 10 to 15. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies.

推薦指數 30 10. Japan Corporate Tax Rate History. 2 Japan tax newsletter 13 February 2020 Corporate taxation 1.

If the tax return is filed late a late filing penalty is imposed at 15 to 20 of the tax balance due. Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020 reaching an all time high. Revision of the consolidated taxation.

Employer Social Insurance Contribution Rate. Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020. Dec 1993 Yearly.

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark. GIG is a specialist group established to respond to the various needs of foreign companies developing business in Japan.

The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy. Choose a specific income tax year to see the Japan income tax rates and personal allowances used in the associated income tax calculator for the same tax year. 2020 Japan tax reform outline.

Personal Income Tax Rate. National Health Insurance Rate. This page provides - Japan Corporate Tax Rate - actual values historical data forecast chart statistics.

Employee Social Insurance Contribution Rate. Japan corporate tax rate 2020. Japan corporate tax rate 2020.

The maximum rate was 524 and minimum was 3062. 13 February 2020 Japan tax newsletter Ernst Young Tax Co. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Diversity Equity Inclusion at Deloitte Japan. Film royalties are taxed at 15. Corporate Tax Rate in Japan remained unchanged at 3062 in 2021.

Corporate Tax Rate in Japan averaged 4083 percent from. Data published Yearly by National Tax Agency. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. In the case that a corporation voluntarily files the tax return after the due date this penalty may be reduced to 5. New data on corporate tax rates for the years 2000-2020 was added on JanPDF Japan Highlights 2020 - DeloitteThe effective tax rate for corporations inclusive of the local inhabitants and enterprise taxes based on the maximum rates applicable in Tokyo to a company Worldwide Corporate Tax Guide EYGovernments worldwide continue to.

What is Corporate Tax Rate in Japan. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. The tax rates applied to profit and loss sharing groups will be.

A Look at the Markets. The Corporate Tax Rate in Japan stands at 3062 percent. The Corporate Tax Rate in Japan stands at 3062 percent.

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

What Would The Tax Rate Be Under A Vat Tax Policy Center

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Germany Tax Information Income Taxes In Germany Tax Foundation

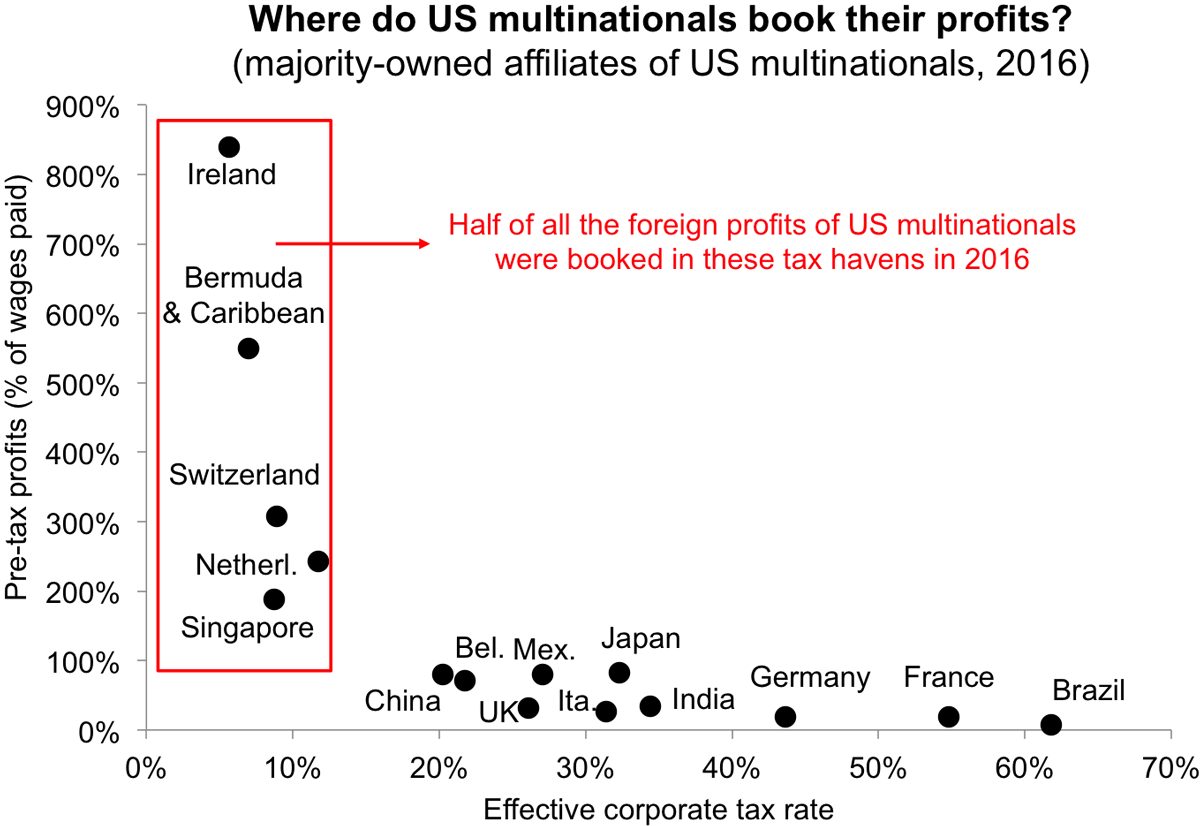

Taxing Multinational Corporations In The 21st Century Economics For Inclusive Prosperity

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Doing Business In The United States Federal Tax Issues Pwc

Canada Tax Income Taxes In Canada Tax Foundation

Germany Tax Information Income Taxes In Germany Tax Foundation

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Poland Tax Income Taxes In Poland Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

The Effects Of Covid 19 On Tax Audits And Controversy Global Employer Services Deloitte Japan

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Corporation Tax Europe 2021 Statista

Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

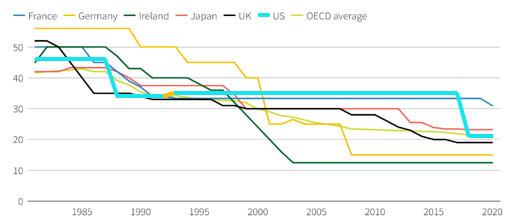

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute